Tax. It’s pretty much a word spoken in dread by performers and artists, and like most of the things we fear, it’s powerful because we don’t understand it. Well, that’s not entirely fair – it’s powerful also because it’s backed up by laws, the Income Tax Act No. 58 of 1962 specifically. But it need not be scary in its power; in fact for most of us the benefits of the tax system far outweigh the personal costs. Despite sharing a name with a notorious virus, SARS is there to help you. At least that’s what I thought I’d say to make you feel less scared of them. Unfortunately ‘m advised to make it clear that while individuals at SARS may be friendly and helpful, their job is to collect as much tax as is owed to them. So for various reasons most artists early in their careers are paying more tax than they should; and SARS will help you get it back but only if you follow their guidelines. This article will help you understand the tax process and how to use it properly, but the best advice any one can ever have is ask an expert. There are many tax advisors with reasonable fees, as well as internet services like Tax Tim.

All this applies to Individuals, not necessarily to other kinds of entities like companies or partnerships. The information in this guide comes largely from SARS’s own website and from Marc Sevitz from Tax Tim and Brendan Murray along with some other sources. I am not a tax expert and have interpreted and contextualized the information based on my reading and experience. If you have a helpful perspective or have found an error please post a comment or get in touch with me.

First of all, what is income tax?

Income tax is a tax levied on all income and profit earned by a taxpayer, hence the name. Basically it is a percentage of the money you earn that goes to the government. This amount owed is modified in two major ways: those that determine the percentage owed, and the deductions from this amount that you are entitled to.

The Tax Year is from 1st March to 28/29th February, after that you have fixed amount of time to get square with SARS by filing your returns. More on this later…

Tax returns must be submitted by everyone earning over R160 000 per year. If you earn under this amount and all your income is from a single employer who has been taking off PAYE you don’t have to submit. This doesn’t apply to most of us in the creative economy, but if you’re stopping here from somewhere else…

That said it may still be a smart move to submit a return because with PAYE you are probably entitled to some of that back. Which brings us to…

What is PAYE? And who pays my Tax?

You are responsible for paying your tax. However there are processes that are sort of out of your hands. Employers are responsible for paying PAYE tax – that’s Pay As You Earn. Again SARS is literal with the names; instead of waiting for the end of the year tax is taken off your salary or wage by your employer and paid to SARS on your behalf. This is bad because you get less money, but very good because SARS will owe you money – it’s much nicer to be receiving money at the end of the year than to discover how much you owe. In theory there shouldn’t be refund because your employer should be paying all your valid expenses; however in practice, especially early in your career, the PAYE rate will be greater than the amount your liable for. Your employer may take off 25% while you are in fact in the 18% bracket.

You’ll find on your pay slips the deductions made. Keep your slips; having good records will save you a lot of trouble. As I said before, the tax year ends at the end of February – but there is a lot of administration for big companies to do and for you to do too. So Tax Season begins on the 1st of July. From then you can get your tax info in order by chasing after something very important: the mysterious IRP5s.

All your employers over the course of the year have been giving the PAYE tax to SARS; the IRP5 is a record of this. Most companies will post it to you, some will ask you to collect it, and some you’ll need to chase down (but only if you haven’t gotten it by the 1st of July – according to the exasperated accounts manager of the Market Theatre when I started bugging her in April). Your pay slips come in handy here to check that no mistakes have been made.

Here it’s pretty important to note that you shouldn’t ever send SARS your original documents. You should make copies and keep the originals. Brendan Murray describes his ingenious system of record keeping: “You have to keep everything for at least 5 years – that’s a SARS rule. So I have 5 shoeboxes. One for every year in a pile with the most recent at the top. At the arrival of new tax year I toss out the oldest from the bottom, put it on the top and start filling it with my documents and receipts for the year.”

How do I file my returns?

OK, so now we’ve finished a financial year. There are 3 ways to file: you can request SARS post you the forms (you can’t download them because they have barcodes specifically linked to your tax number and then post them back; you can go in person with all your documents to a SARS office; or you can e-file. E-filing is the easiest, you log on to the SARS website and fill out the online forms. The limit of e-filing is that you can only enter 15 IRP5s. A busy actor would get one for each job and so might amass many times more than this. Look for the section on Local Business Income and there’ll be a block for IRP5/IT3a income: add all your remaining IRPs together here. Remember to have copies ready as supporting documentation.

All these require you to get your documents and records in order. We’ve gathered up our pay slips and IRP5s. But if you’re like me you’ve also done a lot of freelance work for small companies and individuals who didn’t take off PAYE. The temptation is just not to declare this to SARS. That’s dishonest and also sort of a crime that can get you fined and even go to jail. But it’s also a widespread practice and is pretty much summed up by the term ‘informal sector of the economy’. My view is that if you’re straight with SARS they’ll be good to you. So far, so good.

So what I do is make an invoice for every job, even when it’s not requested. Here’s a mock one for poster update:

So very important: it says Invoice and it has an invoice number (my system is straight-forward: count them and add the year). Other details it should have: the date, who it’s to, who it’s from, what it’s for, how much it’s for and how it should be paid.

So very important: it says Invoice and it has an invoice number (my system is straight-forward: count them and add the year). Other details it should have: the date, who it’s to, who it’s from, what it’s for, how much it’s for and how it should be paid.

Some of you aren’t just registered as individuals though, are you? Some are registered as other tax entities (companies and wot-not) and so there are rules around invoices that apply when dealing with them. Rob Keith of UCT’s drama department enlightens us:

If you are Vat registered as a company, you must charge and indicate Vat on your invoice. Your invoice must be titled Tax Invoice (not just Invoice). If you do not charge Vat because you are not registered for Vat, your invoice is not allowed to be titled Tax Invoice, only Invoice.

If you are Vat registered, your Vat Registration Number must appear on the invoice as well, to be perfectly in line with SARS regulation.

UCT (as an example) requires that if you invoice them for anything (UCT thus being the costumer), that their Vat number also appears on your invoice, even if you do not charge VAT. This is not only best practice, but will increasingly become the norm when dealing with larger institutes and companies. It may be a wise idea to ask your customer for their Customer VAT number right from the beginning, before invoicing to avoid possible delays down the line.

UCT (again just as an example) will reject any payment that does not align with these requirements – not because they are particularly wanting to be difficult, but because SARS does not give them a choice.

Right, that should cover all your income. Now for the deductions, the answer to the eternal question:

How can I pay less tax?

You can pay less tax by keeping good records. We’ve looked briefly at tracking the money that comes in, but just as vital is keeping track of the money that goes out. In principle the money spent to earn money is deductable however you must be able to prove that the benefits are entirely work related and not personal.

The first step is to hang on to the slips for pretty much everything. All your printing, your pens, notebooks and stationary. All the brown paper, glue, wood and string you use to make puppets. Every screw, bolt and bulb. I told you SARS is your friend. I manage my invoices by writing a number on each of them, noting which project they relate to, and recording them in a nice excel spread sheet while I stick the originals to A4 pages in my flip folder. Everyone loves spreadsheets, right?

Our profession allows us a great deal of flexibility in what we can deduct, as long as we can back it up with paperwork.

The general guidelines are these:

1. Incurred in connection with your trade, business, or profession

2. Must be “ordinary” and “necessary”

3. Must NOT be “lavish or extravagant under the circumstances”

So far all my examples were objects, mostly consumables, so there’s not a lot of room for “extravagance” – but what about necessary costs like accommodation on tour? Or lunch meetings or meals on tour? For meals and travel relating to work SARS has an allowable amount that can be deducted per day. These are found on tables on the SARS website. As for business meetings where food is involved, record who your meeting was with and what it was about. The issue of extravagance really boils down to common sense. You could run up a bill at a five star hotel while on tour and try claiming it as an expense, but you’ve still got to pay it upfront yourself. I hope you’re earning enough on that tour.

Or how about bigger or more expensive items? Like a laptop, a dimmer rack, or a camera? These items don’t get written off in a single tax year which is reasonable considering you’ll be using them over a couple of years. These assets ‘depreciate’ over a couple of years, so for instance you can write off your car over a period of 5 years. The length of time is specified on a table you can download off SARS’s website. (I found it hard to find clarity on the threshold, but it seemed that this rule applies to any item over R7000, as long as it isn’t part of a set whose total value exceeds R7000 – like a chair which should be calculated with the table and other chairs.)

Tax Tim has a table of the periods as well as handy tax calculator on their site.

As performers we get to deduct a lot of things that would be personal purchases for other people, like tickets to shows, and the weird items of furniture we buy as set dressing. There are a lot of misconceptions around these. There are rumours that as long as we get receipts for them we can deduct them – I have heard from a number of folk that haircuts, gym membership and beauty treatments are similarly deductable . They’re not unless you can produce the contract binding you to getting a six-pack, haircut or treatment. SARS are very strict on these sorts of things because there’s a lot of scope for abuse. So if you try to claim for something be prepared to have to back it up (and when you do remember not to send in your original documents). Filing false returns is a criminal offence, and SARS could even come to your home. Don’t claim a lamp as a stage prop and then put it in your living room.

So keep your receipts.

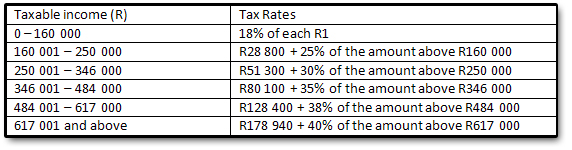

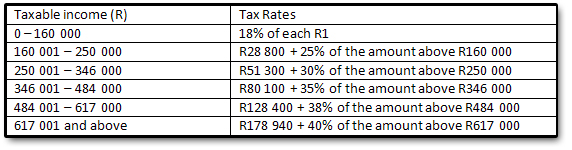

“Oh, come on,” you say, “Surely it’s not a big deal if I miss out on some. I lose out on like, R500 over a year. Whatevs.” Maybe. But here’s the thing… Deductions come before you get put in a tax bracket. So that R500 may mean quite a big difference. Here are the tax brackets:

So that’s it then?

Pretty much. Tax boils down to record keeping. The better records you keep, the more you get out of SARS. Or rather get back from SARS.

In a small fishing community along the West Coast Jay and his Oupa try their best to make a living from the sea. But you need slips of paper and signatures to get at the dwindling fish and perlemoen while police patrol in caspirs and Marine Patrol watch the waters. Despite the dangers Oupa takes Jay out with him one night to pull perlies off the rocks. Bam! Searchlights! They’re caught red-handed by Marine Patrol. But before the authorities can arrest them properly something under the water yanks them away. Suddenly Jay and Oupa in their tiny boat are being towed out to sea… When they finally stop they are drifting in the middle of the ocean, without land in sight.

In a small fishing community along the West Coast Jay and his Oupa try their best to make a living from the sea. But you need slips of paper and signatures to get at the dwindling fish and perlemoen while police patrol in caspirs and Marine Patrol watch the waters. Despite the dangers Oupa takes Jay out with him one night to pull perlies off the rocks. Bam! Searchlights! They’re caught red-handed by Marine Patrol. But before the authorities can arrest them properly something under the water yanks them away. Suddenly Jay and Oupa in their tiny boat are being towed out to sea… When they finally stop they are drifting in the middle of the ocean, without land in sight.